Understanding Working Capital Loans: A Key to Business Success

For many business owners, the term "working capital loan" is more than just jargon; it's a financial lifeline. These loans are designed to provide immediate access to funds needed to cover daily operational expenses and keep the business thriving. They help bridge cash flow gaps that often occur between accounts receivable and accounts payable, ensuring that companies can pay employees, suppliers, and overhead costs on time.

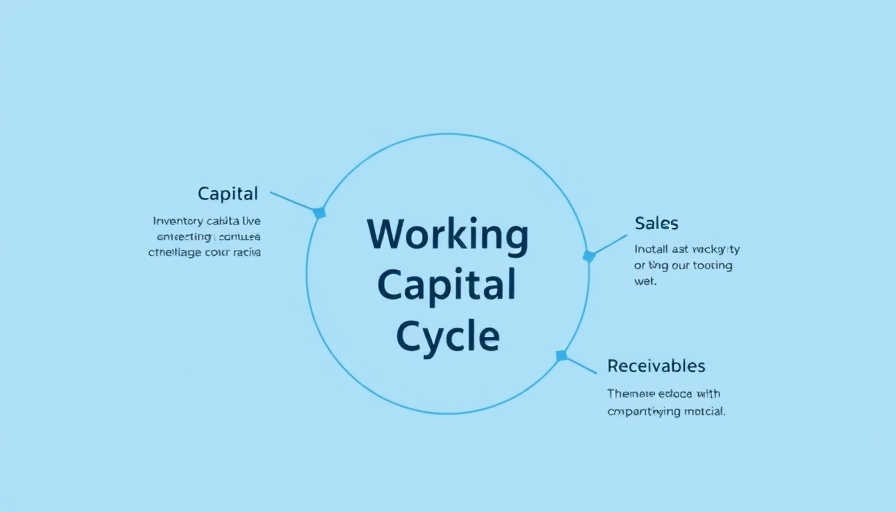

Defining Working Capital: Why It Matters

Working capital essentially refers to the funds necessary for daily operations, and maintaining adequate working capital is crucial for sustaining business operations and growth. In fact, without a reliable influx of cash, even the most promising businesses can struggle to stay afloat. Increasing financial literacy around working capital loans can empower entrepreneurs to make informed decisions. Successful businesses understand the importance of these loans, utilizing them as a tool for growth and sustainability.

How to Secure a Working Capital Loan: A Step-by-Step Guide

Acquiring a working capital loan can be a straightforward process if approached correctly. Here’s a simple roadmap for business owners:

- Determine Your Needs: Assess how much funding you need and for what purpose.

- Research Lenders: Look into traditional banks, credit unions, and alternative lenders. Each offers different terms.

- Prepare Documentation: Gather financial statements, business plans, and tax returns.

- Application Process: Complete the loan application with all required details and documentation.

- Review Terms Carefully: Before signing, ensure you fully understand the interest rates and repayment plans.

By following these steps, doctors, dentists, and entrepreneurs can effectively navigate the loan process, minimizing stress and maximizing financial empowerment.

Evaluating Your Options: Key Considerations

As you contemplate taking on a working capital loan, it’s essential to weigh the cost of borrowing against the potential benefits. Terms such as interest rates, loan duration, and repayment schedules can significantly impact your finances in the long run. These elements should be factored into your financial mindset when making your decision.

Final Thoughts: The Role of Working Capital Loans in Business Growth

In conclusion, working capital loans represent a vital resource that can help businesses weather financial storms and take advantage of growth opportunities. Understanding how to utilize these loans can be a game changer. To ensure that you make informed decisions, consider seeking advice from a financial consultant who can guide you through the options available and tailor a financing solution that works best for your needs.

Add Row

Add Row  Add

Add

Write A Comment